New tax laws to take effect January 2026, says FIRS chair

The Chairman of the Federal Inland Revenue Service (FIRS), Zacch Adedeji, has announced that the newly signed tax laws will come into effect on January 1, 2026. This timeline allows the government six months for planning and sensitization.

During a press briefing at the State House, Adedeji stated, “It takes time for all the stakeholders, participants, operators, and even the regulator, to change the system. So, with the magnanimity of the National Assembly, Mister President, the effective date will be January 1, 2026, by the special grace of Almighty God. We have a full six months for both sensitization planning and also considering the fiscal year of the government.”

He emphasized the importance of implementing the changes at the start of the fiscal year, noting that “the application of law is better used from the beginning of the year.”

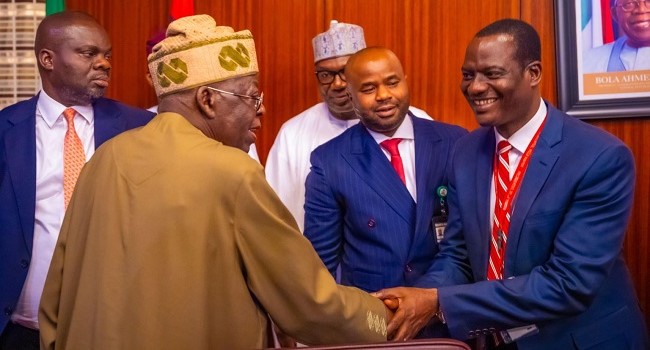

Adedeji’s announcement follows President Bola Tinubu’s recent assent to four tax reform bills that had been passed by the National Assembly. The signing ceremony, held at the Presidential Villa, also saw attendance from key leaders in the National Assembly, governors, ministers, and presidential aides.

The four bills included: the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill, which were approved after extensive consultations with various interest groups and stakeholders.

Source: Channels TV