BREAKING: Tinubu seeks $2.35bn external loan, $500m sovereign Sukuk

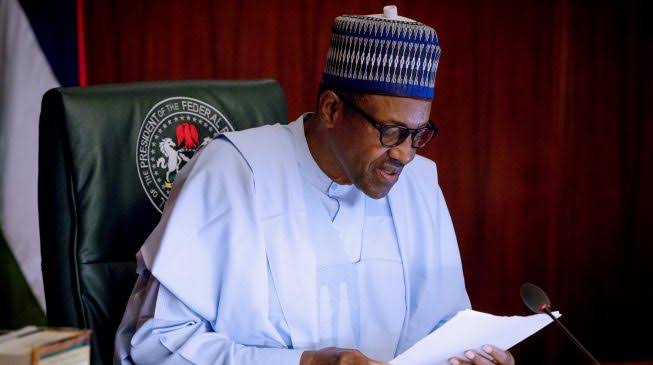

President Bola Ahmed Tinubu has written to the House of Representatives seeking approval to raise $2.347 billion from the international capital market to fund part of the 2025 budget deficit and refinance Nigeria’s maturing Eurobonds.

He also requested approval to issue a $500 million debut sovereign Sukuk aimed at supporting critical infrastructure development.

The President said the request was made under Sections 21(1) and 27(1) of the Debt Management Office (Establishment, Etc.) Act, 2003, and is intended to give effect to the borrowing provisions in the 2025 Appropriation Act.

According to Tinubu, the funds will help refinance the $1.118 billion Eurobond maturing in November 2025 and expand Nigeria’s access to diversified external funding sources.

“The House of Representatives is kindly invited to issue its resolution allowing the government to raise the amount through any of the following options: issuance of Eurobonds, bridge finance facility from bookrunners, loan syndication, or direct borrowing from international financial institutions,” the President wrote.

The 2025 budget provides for N9.28 trillion in new borrowings to bridge the fiscal deficit, of which N1.84 trillion ($1.229 billion) is earmarked for external borrowing.

Tinubu said the move to refinance the maturing Eurobond is necessary to avoid default and aligns with international best practices in debt capital markets.

He added that while all options would be explored, the government’s primary plan is to issue Eurobonds, leveraging Nigeria’s regular participation in the international capital market.

“The terms and conditions will be determined at the time of the transactions and will be subject to prevailing market conditions,” he noted, adding that the Federal Ministry of Finance and the Debt Management Office (DMO) would work with transaction advisers to secure the most favourable terms.

In a related request, the President asked lawmakers to approve a stand-alone debut Sovereign Sukuk of up to $500 million in the international capital market.

Tinubu said the Sukuk would be modeled after successful domestic issuances that have raised over N1.39 trillion since 2017 for road and infrastructure projects.

He explained that the initiative aims to diversify Nigeria’s investor base, open new funding sources, and deepen the sovereign securities market.