INVESTIGATION: Kwara govt bans charcoal production to curb deforestation. But it persist and govt still secretly tax it

By Toheeb Omotayo

The Kwara State Government banned the production and sale of charcoal in the state in July 2018, and has repeatedly issued statements and warnings to enforce the law. Officials justify the ban as part of international best practices designed to protect the environment, preserve natural resources, curb deforestation, and combat climate change.

However, an investigation by The Informant247 reveals that, despite the public ban, the charcoal trade persists, with the state government, through KWIRS and the Ministry of Environment, secretly collecting levies and taxes from producers, transporters, and traders. The investigation gathered receipts, videos, and other evidence, but both the ministry and agencies declined to comment when contacted.

The first thing that strikes a visitor to Alapa community in Asa Local Government Area of Kwara State is not the sound of machines or the chaos of trading, but a deceptive calm that sits over a charcoal industry the government insists no longer exists.

At the edge of the community, where commercial transits ply the busy federal road not knowing what is happening deep inside, The Informant247 met Tunde, a soft-spoken 27-year-old worker at one of the charcoal depots located deep inside the forest.

He was seated on a motorcycle preparing to depart the port, with his whole body already covered in charcoal dust, especially his handglove already too black to be cleaned. When our reporters approached to talk to him, his face carried the tiredness of someone who has worked long enough.

“We don’t sell to small vehicles or local retailers,” he said. “We major in exportation. We buy directly from producers or suppliers, raw. Then we process, package, and export everything through the port.”

When asked about taxes, he stirred uncomfortably. “Suppliers pay tax when moving on the road,” he explained. “Me, I don’t know much about the company taxes; my dad is the CEO. He handles that. But there are many agencies that collect money here.”

He paused, choosing his words carefully. “You see… the government says they are fighting deforestation. They say they want afforestation. My dad attended their stakeholders’ meetings. But how they run it… only they understand.”

The Kwara State Government has prohibited the production, transportation, storage, and sale of charcoal within the state, a ban that has been in effect since it was signed into law in July 2018. The government has repeatedly issued official statements and warnings reiterating that this law remains intact.

The ban is enforced under the “Charcoal Production (Prohibition) Law”. High-ranking officials, including the Commissioner for Environment, have publicly stated that the law is “intact” and violators will face sanctions. A dedicated task force works with security agencies and traditional rulers to ensure compliance, conduct surveillance, and impound vehicles.

The government justified the ban as a measure to protect the environment, preserve natural resources, curb deforestation, and combat climate change. It also set up a dedicated task force to enforce the ban, with penalties of a N100,000 fine or up to two years’ imprisonment for defaulters.

In September 2025, the State House of Assembly again passed an amendment bill for a second reading, which aims to introduce even stiffer penalties for violators.

However, beneath the public official ban, findings show that the unlawful charcoal trade persist, and the state government, through its tax agencies, continues to secretly collect levies and taxes from producers, transporters and traders.

Another Depot, Same Story

Just a short distance from the first depot sits another massive facility. Here, Awal, a manager, didn’t bother pretending the business was small.

“We are a standard company,” he said firmly. “We don’t sell locally. We export to other countries in large amount.”

When asked about tax, Awal broke down the flow, “Charcoal-burners and transporters pay forestry fees. Depots pay forestry levies. Both local and state governments collect taxes once loading on the big trucks is completed.”

Further findings by The Informant247 revealed that there is a multiplayer involved in the supply chain: The charcoal-burners, bulking agents, suppliers, transporters, and exporters – each of whom pay taxes to the designated agents.

“I can’t say much on how the charcoal-burners pay their taxes, but it has to do with forestry,” Adigun disclosed. “We don’t go into the forest. The suppliers bring everything to us. Our own is to process and ship. But taxes? Yes, everybody pays.”

Just a few miles from the port, The Informant247 reporter spotted a truck fully loaded with bags of charcoal coming from a nearby forest.

Profiting from an outlawed industry

Findings by The Informant247 further revealed how the state is quietly profiting from an industry it has publicly outlawed.

When this reporter spoke with a forest guard who requested anonymity, he explained that although illegal logging still persist, it is mostly carried out by plank dealers rather than charcoal burners or producers.

The forest guard, who spoke with our team by the roadside, explained that despite the official ban on charcoal production in Kwara State, the activity continues through a coordinated association of charcoal dealers, adding that the government is aware of this and also use this as a revenue pipe for the state.

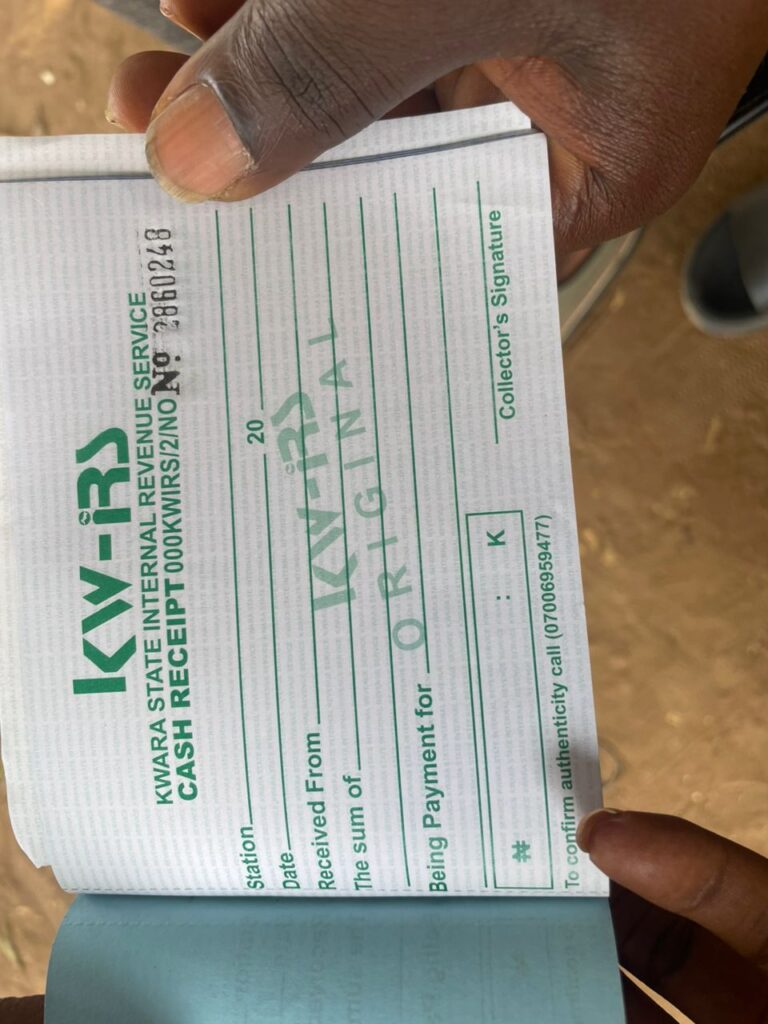

As he spoke, he pointed to a commercial vehicle loaded with sacks of charcoal approaching a designated checkpoint, where a middle-aged man working as a tax consultant for the Kwara State Internal Revenue Service (KWIRS) issued a ticket after collecting payment.

“The government approves their operations. Once a violator’s car is arrested and taken to the Ministry of Environment, that is the end. No chance for appeal. The association is in cahoots with the government which allows charcoal production to continue through lobby. They give them the ‘grace’ to carry out the activity.”

He continued, “Their association has something they remit to the state government,” he said.

Between KWIRS, Ministry of Environment and tax consultants

The forest guard explaining how the taxation process works, stated that the state hires consultants to handle on-the-field tax collection and remit an agreed portion to the government.

“The consultants buy receipts from the Kwara State Internal Revenue Service (KWIRS) and use them to tax charcoal dealers,” he said. “From the money a consultant makes in the field, he must remit a certain percentage to KWIRS.”

He added that the government closely monitors the process. “The government is very careful about the whole thing, so sometimes consultants issue blank receipts to charcoal traders to conceal its purpose. So basically, the Ministry of Environment takes money from the charcoal association while the producers, wholesalers and retailers pay to KWIRS,” he explained.

The forest guard further noted that buying tax receipts does not exempt consultants from remitting part of their earnings to the government. “Despite purchasing the receipts, consultants are still required to pay a percentage of what they make from the field to KWIRS,” he said.

Tax receipts issued to suppliers and transporters are categorized based on vehicle size. Explaining the breakdown, one of the consultants, who requested anonymity, said, “We charge between N300 and N500 for small vehicles carrying charcoal. Small trucks pay N1,000. For big trucks, we charge between N5,000 and N10,000, depending on the load. But for containers, the fee is N10,000 and above,” he told The Informant247.

Findings by The Informant247 also revealed that retailers pay shop taxes to the state revenue service. A simple survey showed that major streets in Ilorin are flooded with charcoal sellers who are also taxed by the state.

“We, the retailers who sell charcoal on the street to consumers, also pay tax, although it is not as high as what the wholesalers and producers pay,” a retailer told The Informant247.

The spokesperson of KWIRS declined comment when contacted. She however asked this reporter to write an official letter to the agency. When our reporter visited the revenue house, he was not allowed in.

The ministry of environment also did not comment on the issue.

This report was published with support and funding from Civic Media Lab