House Reps approve President Tinubu’s request to borrow $2.209bn

Following the consideration of a report by the House Committee on Loans and Debt, which endorsed sourcing the funds from multiple channels, including the issuance of Eurobonds in the international capital market (ICM), debut sovereign Sukuk, and bridge/syndicated loans, depending on market conditions, the House of Representatives on Thursday, approved President Bola Ahmed Tinubu’s request for new external borrowing of $2.209 billion (₦1.767 trillion) under the 2024 Appropriation Act.

The funds are to be raised through Eurobonds and other financing sources.

The Informant247 had earlier reported that President Tinubu had written to the National Assembly over a request to borrow $2.209 billion from external sources to finance the deficit in the 2024 budget.

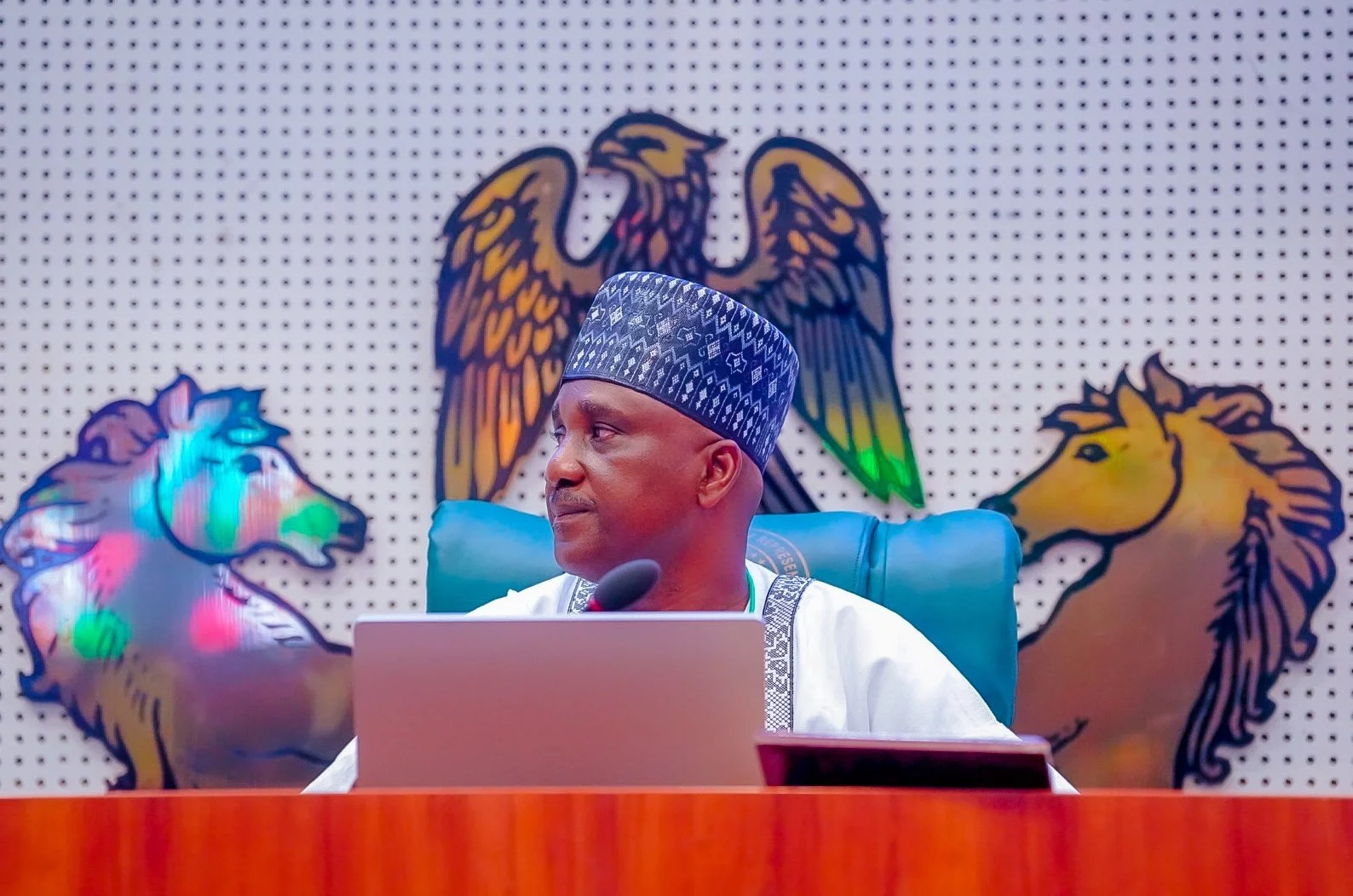

The Speaker of the House of Representatives, Abbas Tajudeen, while reading a copy of the letter on the floor of the House on Tuesday, said Tinubu’s loan request would help to finance the deficit in the 2024 budget, adding that the request is in line with section 21(1) and 27(1) of the Debt Management Office Act,

However, the lawmakers emphasized that the exchange rate adjustment from USD1/₦800 to approximately ₦1,640 should result in surplus funds. These additional resources are to be dedicated exclusively to capital projects in 2024, ensuring they are channelled toward impactful infrastructure and development initiatives that promote long-term economic growth and stability.

It also approved the Promissory Note Programme and Bond Issuance to settle outstanding claims and liabilities of the Federal Government to address outstanding reimbursement debts owed to States, high-priority judgment debts, and other liabilities incurred by Federal Ministries, Departments, and Agencies. This measure is critical to preventing additional interest costs, mitigating further increases in the Federal Government’s debt profile, and reducing the debt-to-GDP ratio.

It asked the Minister of Finance and Coordinating Minister of the Economy, working with the Debt Management Office to take all necessary actions required to give effect to this.

Source: The Nation